Unlocking Financial Freedom: The Rise Of Mobile Lending Apps

In today's fast-paced world, access to credit has become a vital necessity for many individuals. Mobile lending apps have emerged as a convenient solution to this pressing need, providing users with quick and easy access to personal loans without the hassle of traditional banking systems. These apps have transformed the lending landscape, making it possible for people to secure funds with just a few taps on their smartphones.

With the proliferation of smartphones and the internet, mobile lending apps have gained immense popularity, attracting millions of users worldwide. They offer a streamlined borrowing experience, often allowing users to apply for loans, receive approvals, and manage repayments entirely through their mobile devices. As a result, these apps are not only user-friendly but also cater to a diverse audience, including those who may not have access to conventional banking services.

The growing reliance on mobile lending apps raises important questions about their impact on financial literacy and consumer behavior. Are these apps empowering users to take control of their finances, or are they leading them into a cycle of debt? As we delve deeper into the world of mobile lending apps, it becomes essential to understand both their advantages and potential pitfalls, ensuring that users are well-informed when navigating this digital lending landscape.

What Are Mobile Lending Apps?

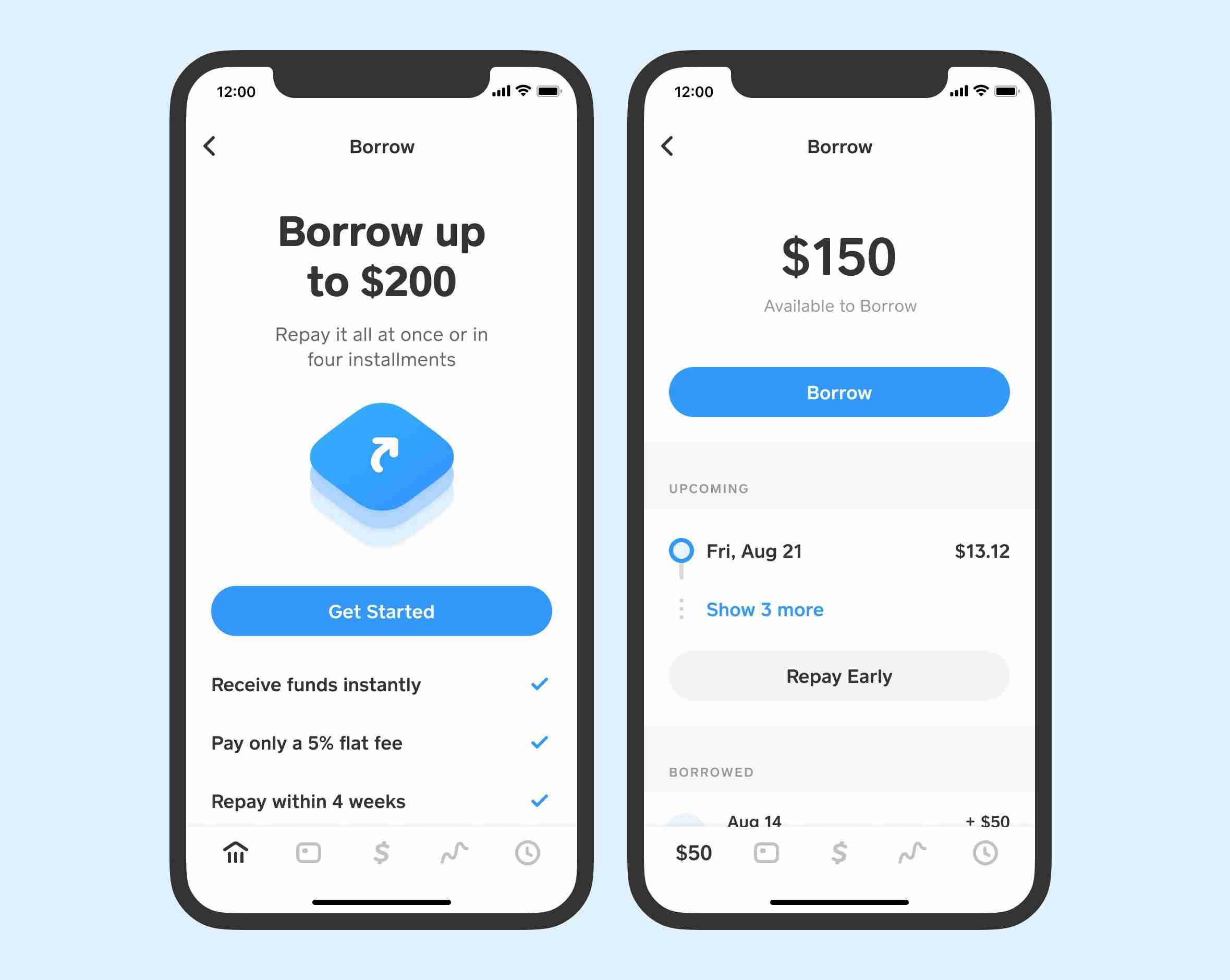

Mobile lending apps are digital platforms that allow users to apply for and manage personal loans entirely through their smartphones or tablets. These applications serve as intermediaries between borrowers and lenders, enabling users to access quick financing without the lengthy application processes typically associated with traditional banks. The appeal of mobile lending apps lies in their convenience, speed, and accessibility.

How Do Mobile Lending Apps Work?

The functionality of mobile lending apps is relatively straightforward. Users download the app, create an account, and submit their loan application by providing necessary information such as income, credit score, and financial history. Once the application is submitted, the app's algorithm evaluates the user's creditworthiness and determines whether to approve the loan. If approved, users can receive funds directly to their bank accounts within a matter of minutes, depending on the app's policies.

What Are the Benefits of Using Mobile Lending Apps?

Mobile lending apps offer several benefits to users, including:

- Quick Access to Funds: Users can apply for loans and receive approval within minutes.

- User-Friendly Interface: These apps are designed to be intuitive and easy to navigate.

- Convenience: Borrowers can manage their loans anytime and anywhere through their mobile devices.

- Flexible Loan Options: Many apps offer a variety of loan amounts and repayment terms to suit different needs.

Are There Risks Associated with Mobile Lending Apps?

While mobile lending apps provide significant advantages, users must also be aware of the potential risks involved. These may include high-interest rates, hidden fees, and the possibility of falling into a cycle of debt. It is crucial for borrowers to thoroughly read the terms and conditions before accepting a loan and to ensure they can afford the repayment schedule.

How to Choose the Right Mobile Lending App?

Choosing the right mobile lending app can be a daunting task given the multitude of options available. Here are some factors to consider:

- Reputation: Look for apps with positive reviews and testimonials from other users.

- Interest Rates: Compare interest rates and fees across different platforms to find the most favorable terms.

- Customer Support: Ensure the app provides reliable customer service in case you encounter issues.

- Loan Amounts and Terms: Choose an app that offers loan amounts and repayment terms that fit your financial situation.

What Does the Future Hold for Mobile Lending Apps?

The future of mobile lending apps appears promising, with advancements in technology and increasing consumer acceptance driving their growth. As more people turn to mobile platforms for financial services, we can expect to see enhanced features, such as improved security measures, personalized loan offerings, and integration with other financial management tools. However, it will be essential for both users and app developers to prioritize responsible lending practices to prevent potential pitfalls.

Conclusion: Are Mobile Lending Apps Right for You?

In conclusion, mobile lending apps represent a significant shift in how individuals access credit and manage their finances. While they offer numerous benefits, including convenience and speed, it is crucial for users to approach them with caution and understanding. By thoroughly researching options and considering their financial situation, borrowers can make informed decisions that align with their financial goals.

Unveiling The Truth: Did Paris Hilton Have Plastic Surgery?

The Controversy Surrounding The Beach On Bourbon: A Louisiana Lawsuit Unfolds

Exploring The Talented Career Of Danielle Rose Russell In Movies And TV Shows